VOLUME 1, NUMBER 1 | SPRING 1998

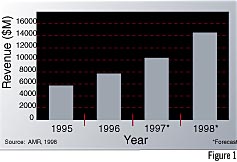

| This year will set new records for sales volume and growth in the worldwide Enterprise Resource Planning (ERP) software market. In 1997 performance was considerably stronger than expected. Early in 1997, Advanced Manufacturing Research (AMR) had estimated overall revenue growth for ERP vendors to reach 34 percent. By the end of the third quarter, we raised our growth estimates to 45 percent, bringing software vendor revenues more than $10 billion. |

|

In 1998, AMR expects the ERP market to grow by another 37 percent, yielding revenues close to $15 billion. It is important to note that these reported software vendor revenue figures represent only a portion of the spending driven by this burgeoning market. |

This year's $10 billion software market is backed by an additional $15 billion in third-party services and at least another $10 billion in computer hardware, networking equipment and systems software to support ERP implementations. Thus, the economic reach of the ERP market exceeds $35 billion, making it one of the largest and most strategic information technology markets.

Amid this consistent growth, big questions remain: Where are we in this traditionally cyclical market? Can it sustain this 30-40 percent growth rate, and for how long? Is this market being primarily driven by the Year 2000 problem, meaning that as we get closer to the millennium, demand for these systems will drop significantly? A close look at current market conditions suggests that while the Year 2000 problem may have given this market an early boost, it is not the primary driver today and will have little impact on future sales. Our analysis makes it clear that we are still quite early in the ERP life cycle and that growth in this segment should continue to be very strong for at least the next five years. In fact, by the year 2001 we expect annual ERP revenues to exceed $20 billion and cumulative ERP sales over the five-year period from 1997 through 2001 to exceed $65 billion.

| This is Not the Traditional Cyclical Market |

From the late 1970s through the early 1990s, an estimated 80,000 manufacturing sites installed business systems, both purchased and homegrown, on mainframes, minicomputers and PC-LANs. The majority of these sites were located in North America and Western Europe. Most used packaged software offering functionality that reflected the MRP II concepts developed and promulgated by the Educational Society for Resource Management (APICS). Most of these systems are still in use today.

The ERP systems that began to appear on the market several years ago did not represent a new concept in manufacturing or information management; they were simply the next stage in the evolution of MRP II. The primary difference between MRP II and ERP is the software architecture, not the functionality. Most MRP II systems are host-based, use character-based user interfaces and were built around proprietary computing platforms (i.e. IBM/390, AS/400, VAX, HP3000, etc.). The new ERP systems are designed to be platform independent and offer client/server architectures and graphical user interfaces. In addition to these technological improvements, most ERP systems feature expanded functional scope and far better support for multi-national and multi-site business environments. In many cases these systems were built specifically for the MRP II replacement market by the same software vendors who designed the earlier systems.

These vendors recognized that their customers were ready to buy new business systems and that they thoroughly understood the functional and technical requirements. Generating demand from this market was easy: Stop enhancing your older systems and build the features that your customers are demanding into the new software package. Ease of use, improved data access, multiple language and currency support appealed to the users, while the IT professionals focused on technology improvements and an answer to the dreaded "Year 2000" issue.

The application vendors were not alone in their crusade to switch manufacturers to ERP systems. The hardware vendors recognized that ERP represented an ideal opportunity to sell client/server systems, networks, PCs, etc., and they jumped on the bandwagon. In some ways the most unexpected participant in this market was the consulting community. Because most MRP II vendors offered their own professional services, there had always been an uneasy relationship between the software vendors and consultants. With the advent of ERP systems, the major consulting firms recognized an enormous opportunity to build their implementation practices, and they became the most vocal and influential advocates of these new systems.

With all of these forces in alignment and a rapidly changing business environment that the existing systems failed to support adequately, the demand was unleashed. Most of the installed MRP II systems have been in place for more than five years � many for 10 or 15 years. This represents a huge prospect base for ERP systems that is still largely untapped. AMR estimates that less than 20 percent of the 60,000 to 70,000 host-based MRP II systems have been replaced by ERP systems. These are the perfect buyers for a variety of reasons:

- They are easy to find because the software,

hardware and consulting companies already

have them as customers.

- They are conditioned to buying packaged

software systems.

- They share a common view of their business

system requirements.

- They attend the same conferences and trade

shows, read the same periodicals and buy and

sell from one another.

- Most believe their existing systems don't fit their businesses anymore.

|

Beyond the Year 2000 Problem: The IT Landscape has Fundamentally Changed |

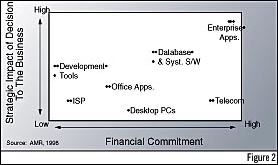

Fundamentally, the enterprise application backbone decision determines how a company will run its business and thus, it becomes the driver of the ensuing IT strategy (computer platform, database, networking and systems integration partner.) In fact, ERP decisions are now often the basis for a company's entire reengineering strategy.

Fundamentally, the enterprise application backbone decision determines how a company will run its business and thus, it becomes the driver of the ensuing IT strategy (computer platform, database, networking and systems integration partner.) In fact, ERP decisions are now often the basis for a company's entire reengineering strategy.To say that the Year 2000 problem alone is driving this market misses this fundamental shift in the IT landscape. Moreover, other significant drivers are spurring demand.

| Multiple Influences Promoting Demand |

ERP is also rapidly expanding into untapped vertical market segments like Services and Retail. This expansion is supported by the growing availability of trained implementers.

In conclusion, even if the ERP market cannot sustain its current 40 percent+ growth rate, 25-30 percent over the next five years seems quite likely. This is good news for buyers and sellers alike. Manufacturers can count on financially healthy vendors with the resources to continue to enhance and support their products. And these vendors will be able to invest aggressively in their businesses with the assurance that the market exists to continue to reward superior management and execution.

| About the Author |

Tony Friscia, founder and president of AMR, has more than 15 years experience with manufacturing information systems as a market analyst, consultant and product line director. In leading AMR's research strategy, he has worked extensively with global manufacturers to define the requirements for customer-oriented manufacturing and to assess manufacturing software in the context of addressing these requirements. Under Friscia's leadership, AMR has become the leading supplier of market analysis on the manufacturing software industry, covering all areas of importance to global manufacturers including supply chain management systems, enterprise planning systems, and manufacturing execution and control systems.

Tony Friscia, founder and president of AMR, has more than 15 years experience with manufacturing information systems as a market analyst, consultant and product line director. In leading AMR's research strategy, he has worked extensively with global manufacturers to define the requirements for customer-oriented manufacturing and to assess manufacturing software in the context of addressing these requirements. Under Friscia's leadership, AMR has become the leading supplier of market analysis on the manufacturing software industry, covering all areas of importance to global manufacturers including supply chain management systems, enterprise planning systems, and manufacturing execution and control systems.Prior to starting AMR in 1986, he was director of industrial product marketing for Concord Communications and had founded and directed Computer Integrated Manufacturing research services for both the Yankee Group and International Data Corporation. In these positions, he directed all market analysis and consulting activities for global 1000 manufacturers and their systems suppliers. Friscia started his career at IBM in the Systems Communications Division in Kingston, N.Y., in 1978. Friscia speaks frequently on manufacturing strategy and the future of the manufacturing software industry at executive conferences and user group meetings. He can be reached via e-mail at: [email protected] |